santa clara county property tax due date

Thats Not Because Our Local Tax Collectors Are Unsympathetic. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

Can I Receive A Refund From The Irs For Overpaid Taxes San Jose Ca Tax Lawyer

Due date for filing statements for business personal property aircraft and boats.

. Proposition 13 the property tax limitation initiative was approved by california voters in 1978. December 10 2021 due by. December 10 - First installment payment deadline.

COUNTY OF SANTA CLARA. Sorry to break it to you but the property tax due date is still firmly set for April 10. Enter Property Parcel Number APN.

The County Assessor establishes the value of property on January 1. The taxes are due on August 31. The City of Santa Clara is committed to offering reasonable accommodations to job applicants with disabilities.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This date is not expected to change due to COVID-19 however assistance is available to individual taxpayers. Powerapps onboarding examples christmas mug exchange game santa clara county property tax due date 2022.

If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. Last Day to use this site for eFiling.

Payments are due as follows. January 1 - Lien date for all taxes for the coming fiscal year. Santa Clara Basin Stormwater Resource Plan Public Meeting from wwwcimilpitascagov.

Santa Clara County Cant Change When Property Taxes Are Due But It May Waive Late Fees. October - Treasurer-Tax Collector mails out original secured property tax bills. Property tax due date.

Twitter Santa Clara County The Office Of Assessor. But because the median home value in Santa Clara County is incredibly high at 829600 the median annual property tax payment in the county is 6183 the second highest in California behind Marin County. On Monday April 12 2021.

Royal langnickel essentials gouache santa clara county property tax due date 2022. Novogratz brittany futon sofa April 26 2022 0 Comments 802 pm. Beginning April 11 property owners unable to pay on time for reasons related to COVID-19 may submit a request for penalty cancellation online.

Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

Santa clara county property tax due date 2022. A 10 penalty is added as of 500 pm. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm.

The key dates in the santa clara county property tax calendar are. Unsecured Property annual tax bills are mailed are mailed in July of every year. Santa clara county property tax due date 2022.

April 10 What if I cant pay. Business Property Statements are due April 1. Last Day to File Without 10 Penalty.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. SANTA CLARA COUNTY CALIF. On Monday April 11 2022.

Photo by Devrin Namar via Shutterstock That old saw about the certainty of death and taxes holds true for property ownersbut everyone else gets a little more leeway in paying the. This date is not expected to change due to COVID-19. The fiscal year for Santa Clara County Taxes starts July 1st.

Second installment of secured taxes due. As of 01042022 there was 13328 cases total new cases for the week starting 12272021 all variants in santa clara county and there are only 64 icu beds out of 3800. Taxes due for July through December are due November 1st.

SCC gov BPS Filing Due Date. If not paid by 500PM they become delinquent. City of Santa Clara Benefit Summary Overview for.

November 1 - First installment is due on secured tax bills. The due date to file via mail e-filing or SDR remains the same. When is the secured tax assessed.

January 22 2022 at 1200 PM. If you need assistance or an accommodation due to a disability please contact us at 408 615-2080 or HumanResourcessantaclaracagov. Property taxes are levied on land improvements and business personal property.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. FY2020-21 PDF 150 MB.

Santa clara countys due date for property taxes is what it is. By - April 26 2022. Deadline to file all exemption claims.

The countys Tax Collectors Office has set up a special team to process requests for those who can demonstrate they were affected by the outbreak. Senior citizens and blind or disabled persons in Santa Clara County can apply for a postponement on their property tax as long as they are at least a 40 owner of the property and. The following table shows the filing deadline for each county.

Payments are due as follows. Learn all about Santa Clara County real estate tax.

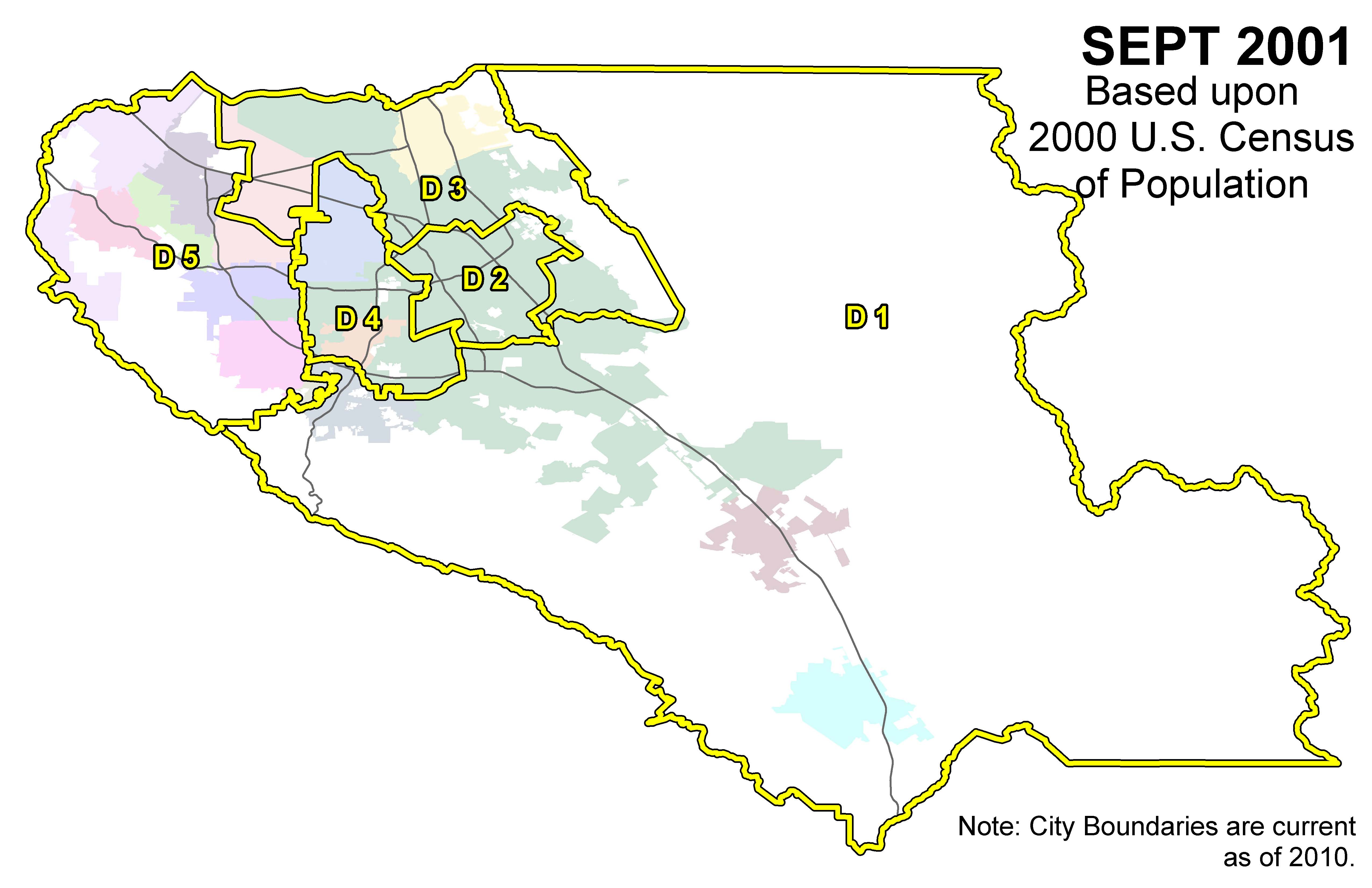

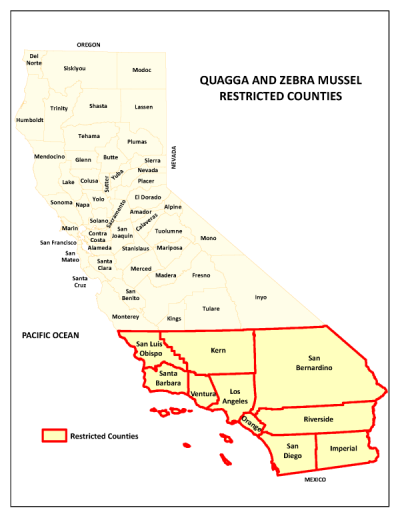

Boating In Santa Clara County Reservoirs Parks And Recreation County Of Santa Clara

Class Specifications Sorted By Classtitle Ascending County Of Santa Clara

San Diego County Ca Property Tax Search And Records Propertyshark

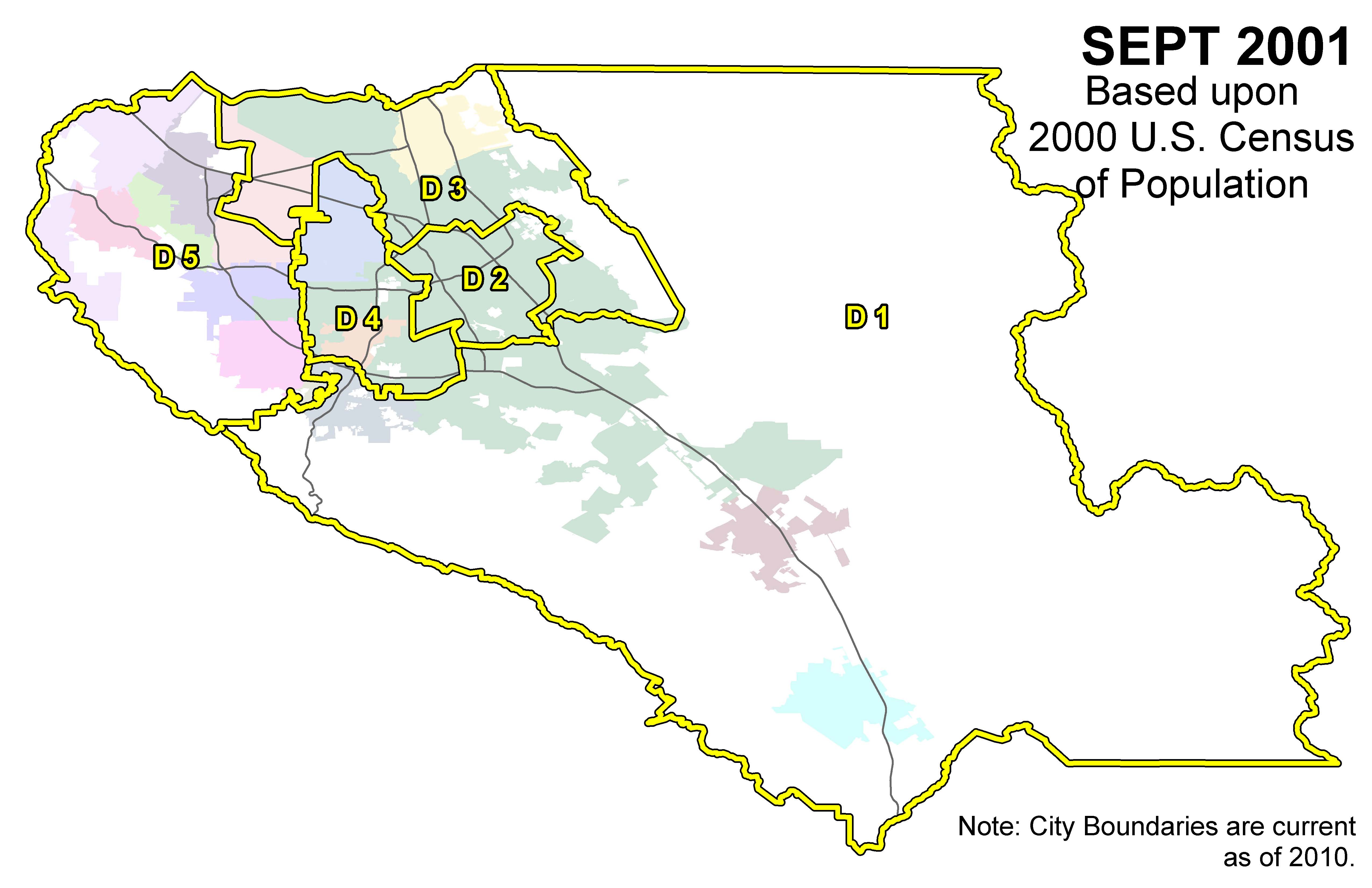

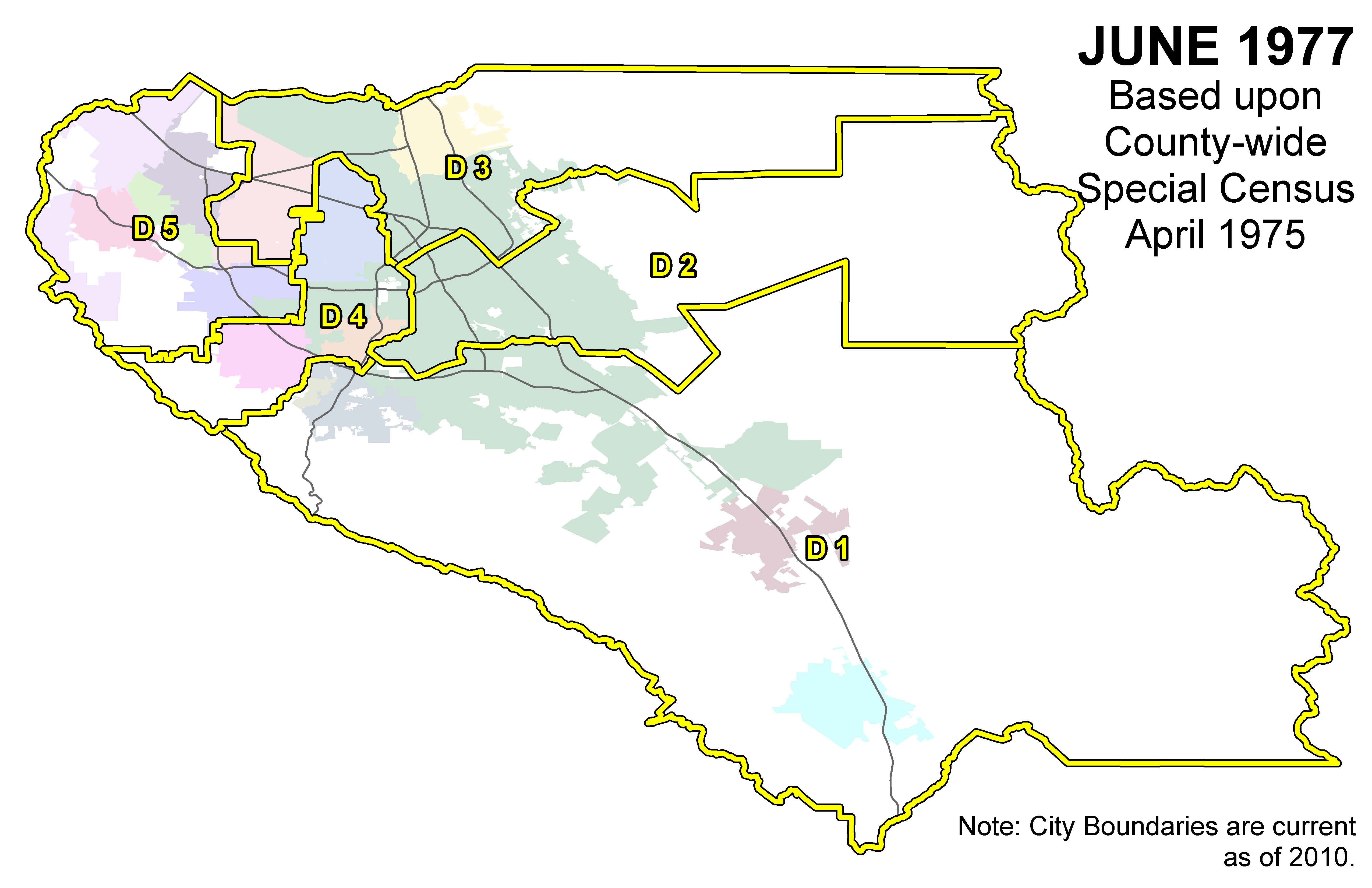

Redistricting Resources Office Of The County Executive County Of Santa Clara

Can You Search Vrbo By Property Number

Redistricting Resources Office Of The County Executive County Of Santa Clara

Parking Services Department Of Tax And Collections County Of Santa Clara

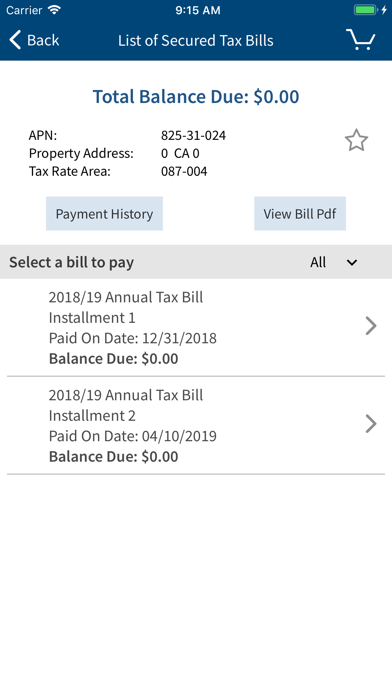

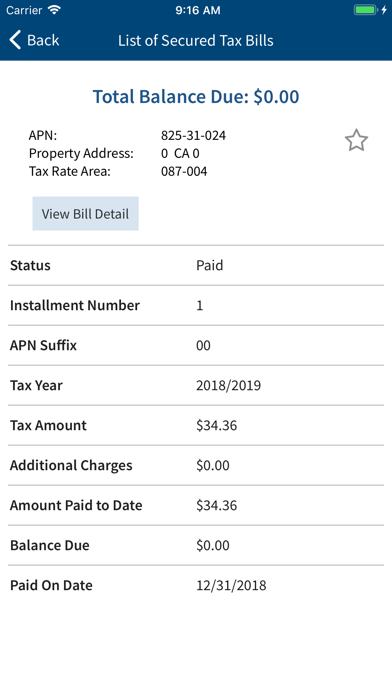

Scc Dtac Iphone Ipad Apps Appsuke

San Diego County Ca Property Tax Search And Records Propertyshark

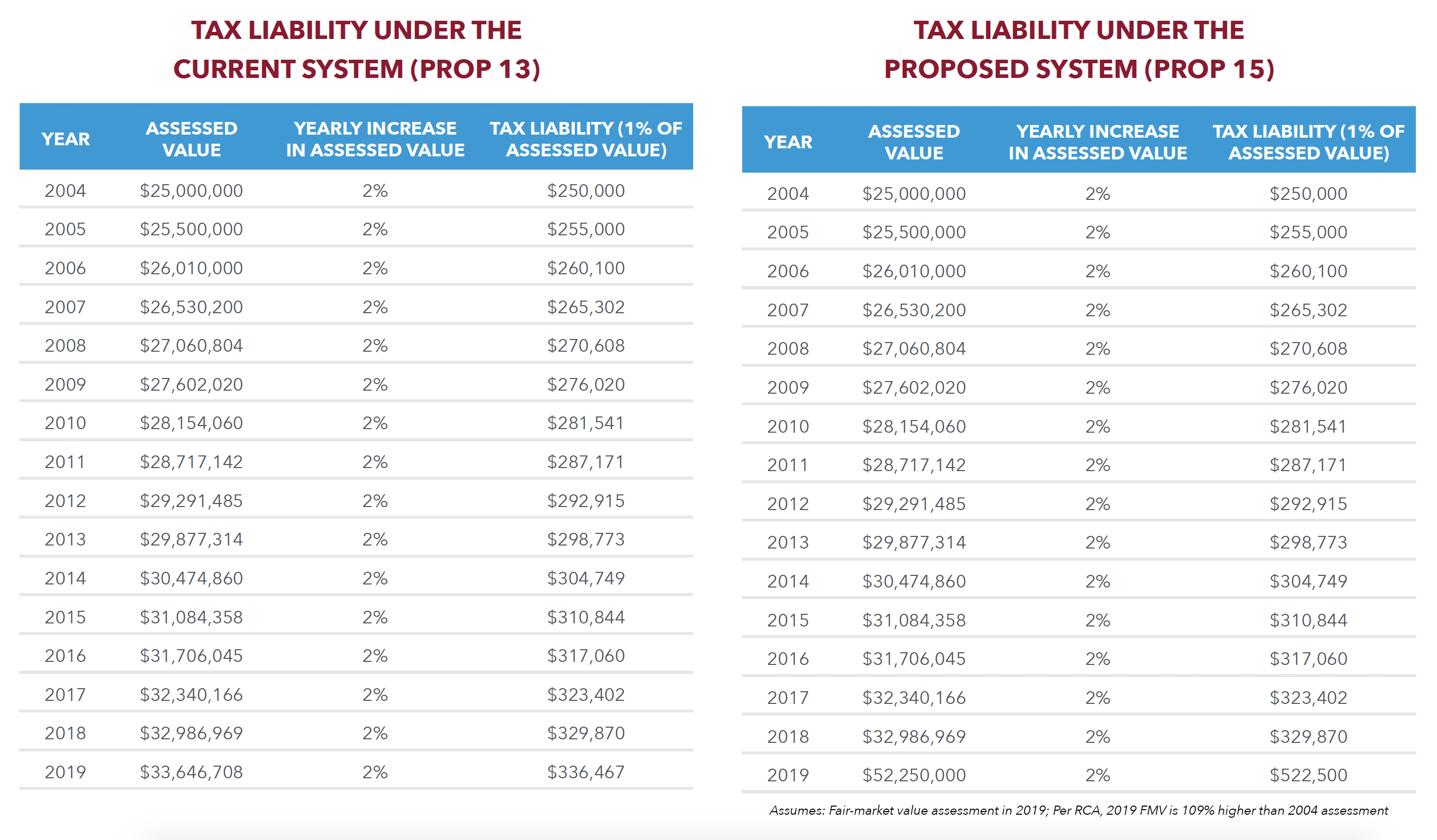

The Impact Of Prop 15 On Commercial Real Estate Lee Associates

San Diego County Ca Property Tax Faq S In 2022

5 Ievs Recipient System County Of Santa Clara

Santa Clara County Gift Deed Form California Deeds Com

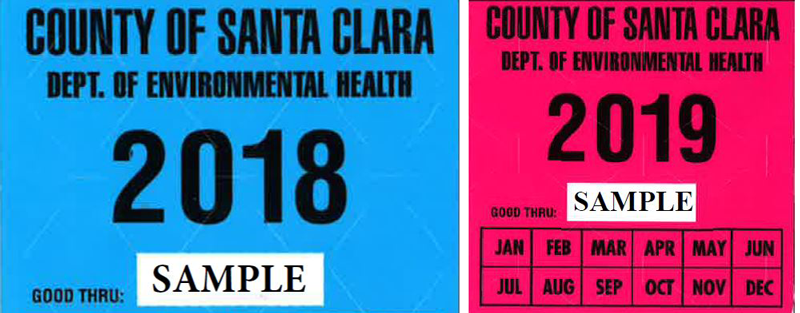

Mff Initial Permit Inspections Permitting Consumer Protection Division County Of Santa Clara

Scc Dtac Iphone Ipad Apps Appsuke

Redistricting Resources Office Of The County Executive County Of Santa Clara